At Mountain Plains Agency Inc, we believe everyone should have access to home insurance that protects both them and their property from unforeseen damage. We have a history of working with the Fort Collins and Northern Colorado communities to protect the assets of hard-working folks for over 13 years. In order to get your peace of mind, you should consider the benefits of having a home insurance policy with Mountain Plains Agency. Our dedicated insurance agents will work tirelessly with and for you to create a policy that fits your needs.

Owning a home is one of the biggest investments you can make. There are lots of potential risks that can damage your investment, which is why having a home insurance policy can protect you from potential damage.

Our home insurance coverage gives you the following:

Any time you work on your home, whether you remodel your kitchen or you build a garage add-on, you are increasing the value of your home. Doing just a bathroom remodel or a kitchen remodel can increase the value of your home by up to 25 percent. Do you have your insurance coverage adjusted after completing these remodels and add-ons? Mountain Plains Agency is dedicated to making sure your home is covered, regardless of your building projects and home improvements.

Insurance to value with Mountain Plains agency has numerous benefits, including:

Your home is a massive investment. Protecting your investments will prevent any unfortunate financial hardship in the case that your home is damaged or destroyed. A homeowners insurance policy covers your home, personal property, liability, and any additional living expenses. Mountain Plains Agency understands how important your home is to yourself, your family, and your financial well-being. Whether you have a condo, a mountain cabin, a townhouse, or anything in between, we will work tirelessly to find an insurance policy that works for you and your home.

Homeowners insurance can vary widely depending on what coverage you want to have. Typically, there are four key components that are covered within your homeowners insurance policy: dwelling, other structures, personal property, and liability. Each one of these has associated costs that you can discuss with your insurance agent. At Mountain Plains Agency, we want to ensure that you rest assured knowing you, your property, and your home are safe.

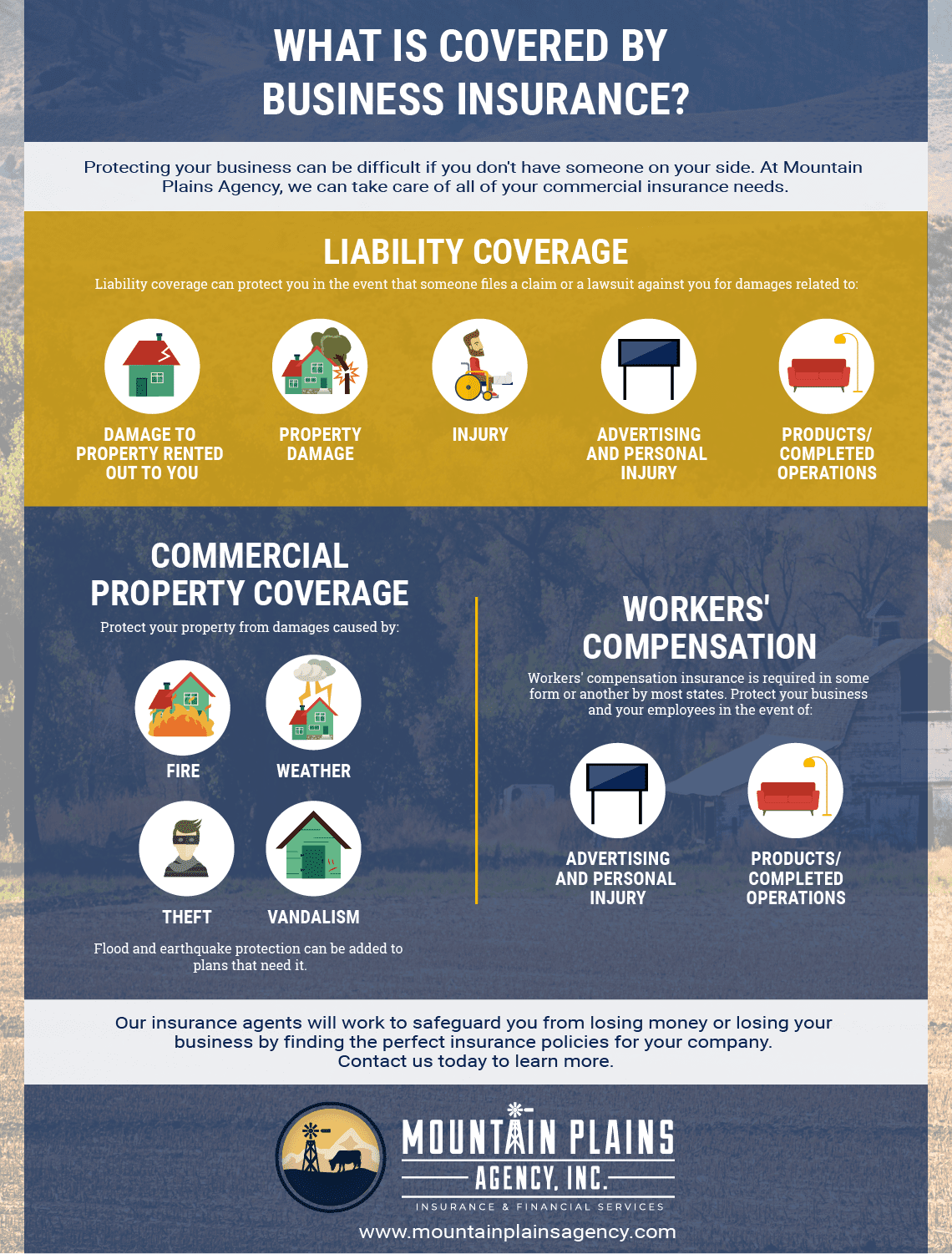

Here is a helpful illustration to demonstrate what you may want covered in your homeowners insurance policy.

Proudly serving Fort Collins, CO, Greeley, CO, Loveland, CO, Boulder, CO, Longmont, CO, Cheyenne, WY, and surrounding areas. Licensed in CO, NE, KS, SD, ND, TX, UT, AZ, WY, MO, IA, ID, IL and NM

Copyright © 2023 All Rights Reserved | Website Designed By Imprint Digital